Close

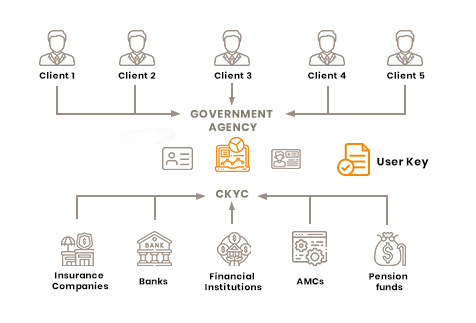

CKYC collects (Stores) and verifies information only once and distributes it to specific client-chosen Telecom Operators, BFSIs, NBFCs and other industries.

FinBraine’s CKYC Registry solutions talk to Government Institutions and Regulatory bodies utilizing APIs

Prevents identity theft, financial fraud, money laundering, and terrorist financing.

saves user from repeated KYC processes, document submission with other institutions after registering with CKYC.

Information stored in CKYC registry is accessible to institutions. Verified users can invest in mutual funds or insurance.

Individual records are accessible to Government bodies, banks, Mutual Fund and Insurance Companies, Brokers etc

Automation of verification and validation of ID documents eliminates manual workflow thereby shortening turnaround time

Fraud detection –Identity theft and other frauds can be detected at initial stage of transactions

Multilingual support for making the product easy-to-market across different countries

Faster customer on-boarding – paperless, hassle free on-boarding provides a wow experience to customer

Ease of customization –Modular architecture makes it possible to selectively configure and customize the functionality you need

FinBraine offers lending and digital KYC solutions on B2B and B2C Models