Close

with an individual credit report detailing their credit agreements

with comprehensive information to help with credit assessments

Central Bank/NBE - with better insights into national trends in the provision of credit

Information submitted by lenders to the CCB is used for creating individual credit reports. The customer has a right to request for their credit report.

New Customer Acquisition is restricted due to lack of central repository with data of walk-in customers

Lending, Credit, and Financing have evolved drastically in last couple of years. The way consumers access credit today is far different from what it was almost a decade back. Traditional scoring agencies have lagged behind when it comes to implementing technology to assess creditworthiness of a potential loan applicant.

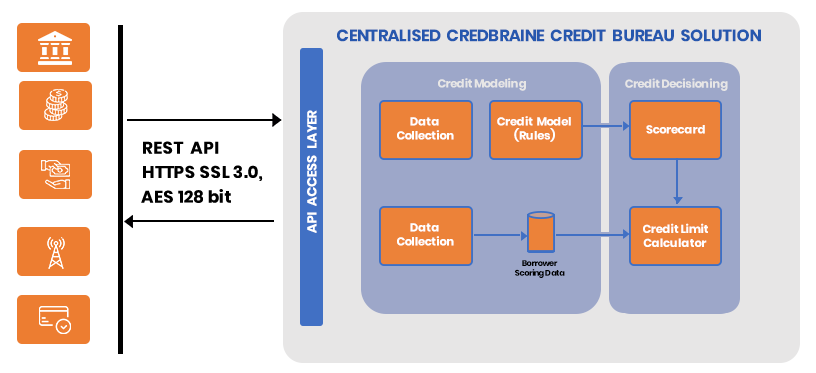

Finbraine’s Centralised Credit Bureau (CCB ) platform for information exchange within the banking and non-banking sectors empowers organisations to store and distribute information and intelligence. CCB store Banking, Personal, Financial and Credit/Lending information for allowing any loan/lending issued within the country

Use of standardised decision-making tools increase the value of data shared and stored.

AI-based Credit Score Ratings for any individual in country

Public Private Partnership ( PPP ) mode of operation offered by FinBraine to the Central Bank of country

CCB scoring registry system provides collective positions of credit monitoring that include all data and information about their borrowings and ratings

Lending organizations can access the customer’s consolidated positions which help them in their credit granting, renewal and increase decisions

NBE can have better control and view the lending. Since lending is the backbone of an economy, NBE helps reduce the informative asymmetry between lenders and borrowers

Enhance the ability of borrowers/issuers to access the money market and the capital market for tapping a larger volume of resources from a wider range of the investing public

Assist the regulators in promoting transparency in the financial markets

Provide intermediaries with a tool to improve efficiency in the funds raising process

Supports the Central Bank’s obligations and functions, including consumer protection, supervising the financial sector and ensuring financial stability

FinBraine offers lending and digital KYC solutions on B2B and B2C Models